The Bank of England is under a slow riding 586 billion pounds of £

Its historical decision, the edge of a knife to reduce inflation on Thursday, but the English Bank will make a worse decision.

It reduces two voting cycles and a small decision 5-4 to reduce the basis of 25 percentages of the problem facing the central bank at high prices.

The matter toured just as I wandered at the most important time for financial policy because banks failed to sponsor after global financial problems.

In 2009, Boees and other central banks were forced to intervene and buy hundreds of billions of bad prices that deserve government responsibilities for complete financial fear.

The process, known as qualitative mitigation (QE), reduces cost -effective cost to support the economy and continue inflation.

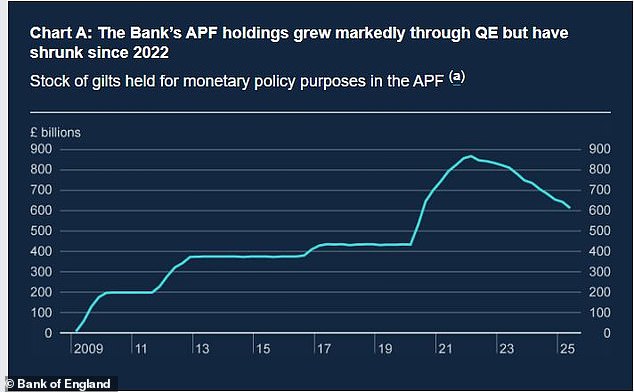

Stockpile: The BOE MA increased 875 billion pounds in 2022

BOE will also be recorded in many QE cycles during the euro area problem, the effects of BRINKIT and epidemiology, which pays their higher obligations to 2075bul.

But the bank now gives its amazing withdrawal in the process known as QT), and more pressures for long -term government borrowing costs.

And 30 years outside the yield-the interest has paid 85 percent of 5.36 percent 5.36 percent in the past 12 months, and 10 years up to 4.55 percent to 4.55 percent.

Fruits, and the transition to the price of the price, especially reflects pricing-long-term price-but this means that the Bank of England sells the successful market for enthusiastic consumers.

This is included with the next new Gilts to help pay the price of the most important government fees.

The long -term government gives costs not the ability to finance debt, but because they have a strong effect on its partners.

The qt pace is “inevitable”

On Thursday, Boose said that the measurement of the QT effect on the long -term harvesting is a challenge, but it was estimated that it was responsible for 15 to 25B, which is higher than the previous classifications.

“The annual QT review increases the effect of the QT QT speed of 60 billion pounds at the September vote,” said the UK’s polar capital, Georgina Hamilton, Fund’s opportunities.

The Bank of England follows more aggressive with some major central banks by selling worthy of praise on their way, the help of freezing long -term debt conditions should be. ‘

The bank’s share is now expected to be a sect of 558 billion pounds in September 2025, after 10010 pounds from QT QT last October.

But commentators UBS say that the first 100 billion pounds “includes 87 billion pounds of fishing operations, which cannot affect the market from sales.

QT is expected to reduce £ 35 billion next year and “GT Active Qt is not the option,” according to UBS.

He added: ‘The stable QT can mean a value of 100 billion pounds, an effective increase in QT from 9.3 billion dollars to 47.3 billion dollars.

“The initiative of this size may be expected to have an impact on an unacceptable market.

“We are looking forward, the QT QT has decreased to 40 pounds for several years. It seems that the QT’s drain to reduce the effectiveness of active sales is not safe.”

P’HHRARIC GARVEY and Michiel Tuker commentators said that there are other options in the Bank of England, but they warned that the UK’s loan viewpoint will always be a challenge.

They wrote on behalf of: “Most liquidity continues in the system, which is one of the ways to deal with fears is to reduce the maturity of trade.

While we believe that such solutions can help at the closest help, the fact is that the UK faces great financial challenges and more printing presses in long numbers. Any such amendments will not face many challenges facing the challenges facing Gilts. ‘

DIY investment platforms

Compatible links: If you take the money product, the committee may receive. These deals were chosen by our planning set, where we believe it is appropriate to highlight. This does not affect our freedom of organization.

Compare the best investment account