How air cargo dynamics are redrawing the global map

- Thriving in freight forwarding requires adopting digital platforms to reach new customers, gain business insight, and turn local expertise and agility into scalable advantages, rather than simply responding to market pressures.

- Technology enables small freight forwarders to reduce acquisition costs, highlight untapped trade lanes, differentiate through specialized services, and reallocate efforts from chasing leads to strengthening customer relationships.

- Trust, sustainability, and cultural adoption are key: freight forwarders must integrate technology with human engagement, offer environmentally friendly solutions, and foster consultative selling to remain relevant and competitive in a fast-paced, digital marketplace.

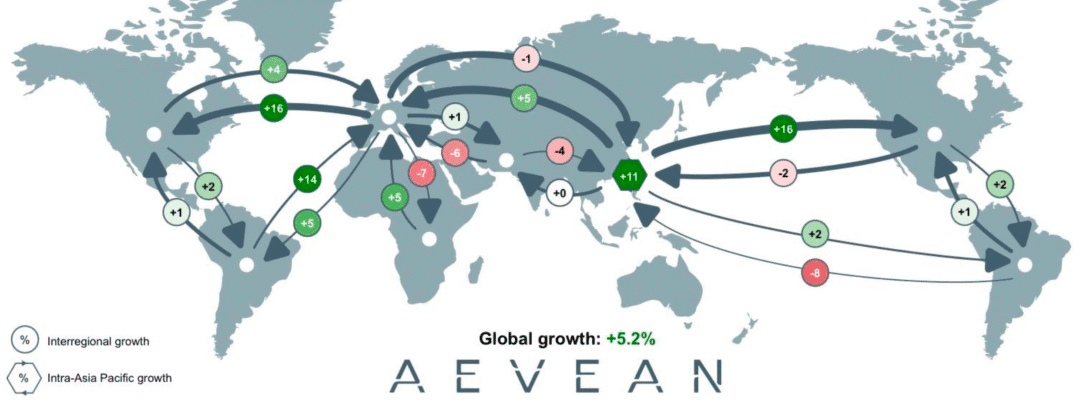

Global air freight patterns are undergoing a subtle but significant shift, with the Asia-Europe corridor emerging as a new focal point for growth. According to Evian’s latest analysis, trade corridors linking Asia to Europe are expanding faster than any other transcontinental routes, driven largely by the continued rise of cross-border e-commerce.

“The data shows a clear acceleration in flows between Asia and Europe,” says Martin Wormer, head of consulting at Aevean. “E-commerce volumes were up by around 18% in the first half of 2025 compared to the same period in 2024. What is particularly interesting is that this growth is starting to touch Middle Eastern hubs and networks, even though the region is not yet among the largest final destinations.”

“Traditional air freight on routes such as Asia-US or Asia-Europe has been replaced by e-commerce shipments,” Wormer points out. “Both sectors are competing for the same limited capacity. As retailers and logistics players prioritize fast-moving consumer goods, this inevitably leads to a reduction in space for other types of goods.”

The numbers support this view. Evian’s analysis shows that since 2019, Chinese low-value e-commerce exports have grown by almost 45% annually, adding more than four million tons of additional volume. This increase has redefined how airlines allocate their fleets and how airports are positioned within the network.

From transit station to strategic player

The Middle East’s role in global air freight is evolving alongside these trade shifts. Long viewed primarily as a transit bridge between Asia, Europe and Africa, the region has now become strategically central to the industry’s next growth phase.

“Capacity growth clearly tells the story,” Wormer says. “From April to August of this year, available shipping capacity along the Asia-Middle East-Europe corridor grew at double-digit rates, far outpacing the trans-Pacific and trans-Atlantic corridors. The shipping fleet is being pulled toward this geography in every sense of the word.”

This trend reflects both opportunities and constraints. With e-commerce volumes increasingly diverted away from the United States – in the wake of the end of the minimum exemption that once made low-value imports more attractive – Europe and Southeast Asia have absorbed most of the redirected traffic. Gulf states, despite their fundamentally small size, benefit indirectly as transport companies redirect and consolidate flows through their hubs.

“The Gulf is not yet the main recipient of these parcels,” Wormer admits. “But its airports and airlines have become indispensable for transporting them. As volumes between Asia and Europe rise, the Middle East’s geographic and operational advantages mean it will naturally gain a greater role in connecting those dots.”

Looking ahead, the numbers point to deeper structural change. Aevean fleet data indicates that most of the freighters and wide-body aircraft currently in demand in the world are destined for operators in the Middle East. “This will fundamentally reshape the global capabilities map over the next decade,” Wormer says. “Depending on how old aircraft are retired, the Middle East could control a much larger share of intercontinental transport. In addition to having more aircraft, it is also about having more influence over the world’s major trade.” Corridors.”