Resilience and challenges of the global economy

The global economy is showing remarkable resilience, despite much uncertainty related to Trump’s tariff policies. However, risks to the global economy remain, with trade relations one of the biggest challenges.

The global economy is showing extraordinary resilience

The global economy is showing remarkable resilience, despite much uncertainty related to Trump’s tariff policies. In September, the Purchasing Managers’ Index (PMI), which shows business activity, reached 52.4 points (50 marks the threshold for positive growth), and in July, August and September overall it reached its highest level of the year. These good results were due to improvements in the service and manufacturing sectors. For the third quarter as a whole, data from major international economies showed some improvement, justifying the OECD’s upward revision of 0.3 pps in its global growth forecast for 2025, placing it at 3.2%.

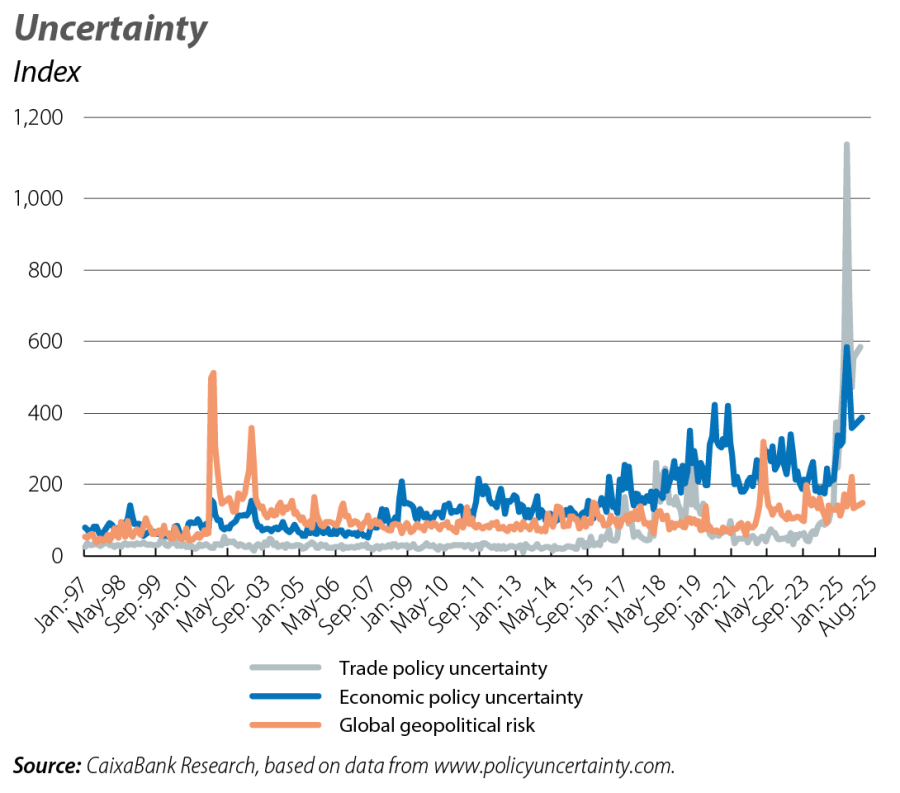

However, risks to the global economy remain, with trade relations one of the biggest challenges. The summer agreement made the “rules of the game” more or less clear and significantly reduced the risk of the worst-case scenario, but uncertainty has not disappeared and further shifts in the US position cannot be ruled out, which explains why the trade uncertainty index is still very high.

The Euro Area closed the next quarter with very moderate growth in Q3

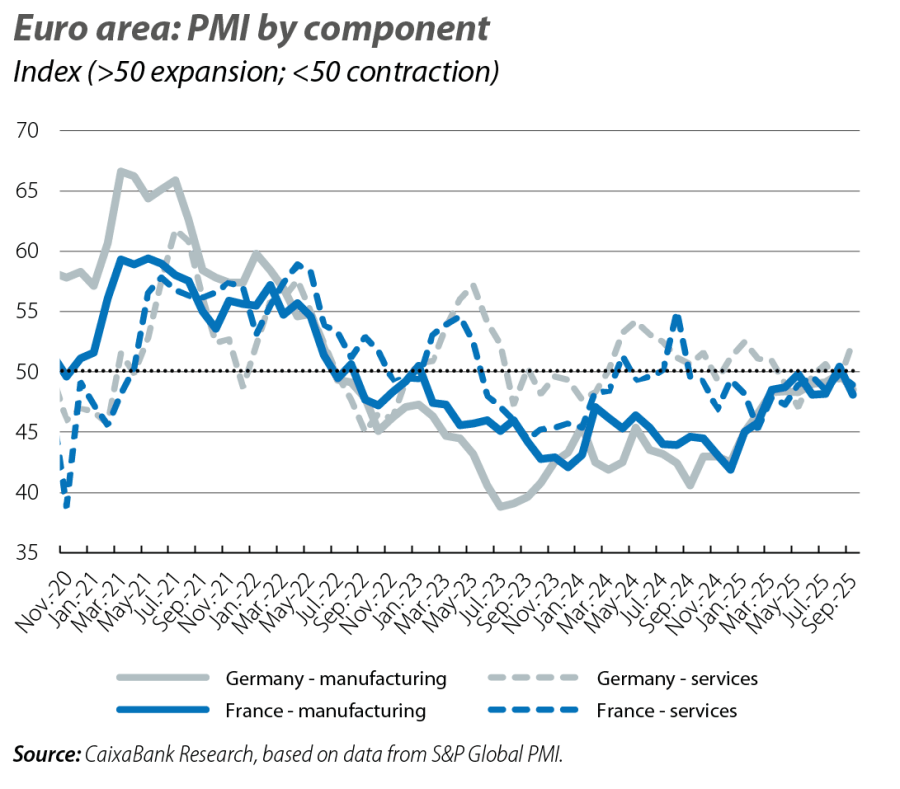

After growth of only 0.1% quarter-on-quarter in Q2, mirroring the declines recorded in Germany and Italy (–0.3% and –0.1% respectively) and France growing solely due to inventory accumulation, the available indicators for Q3 do not suggest any significant pickup in growth in the Euro area. In particular, the PMI rose 0.2 points in September to 51.2, which was a 16-month high but still slightly above the 50-point threshold indicating positive growth, while the average for Q3 stood at 51.0, compared with 50.4 in Q2.

In addition, there are some differences between major countries. Germany closed Q3 on a slightly more upbeat note (PMI rose in September to 52.0), but weakness in orders-related components has dampened any optimism, as demonstrated by the drop in the Ifo Business Climate Index in September (to 87.7, with 100 as the reference threshold).

Although major infrastructure plans have been proposed, they have not yet begun to be implemented, the business environment is still not favorable, and this explains the caution in the German economy in the short term. Meanwhile, economic activity in France remains dependent on the fragile political situation in the country and the PMI fell by more than 1 point in September, to 48.1, marking thirteen consecutive months below the 50-point threshold.

The lack of support for approving a new budget led to the resignation of Prime Minister Lecornu, barely a month after his appointment, reaffirming the climate of political uncertainty and hampering the implementation of measures to lower the fiscal deficit from this year’s GDP forecast of 5.6%.

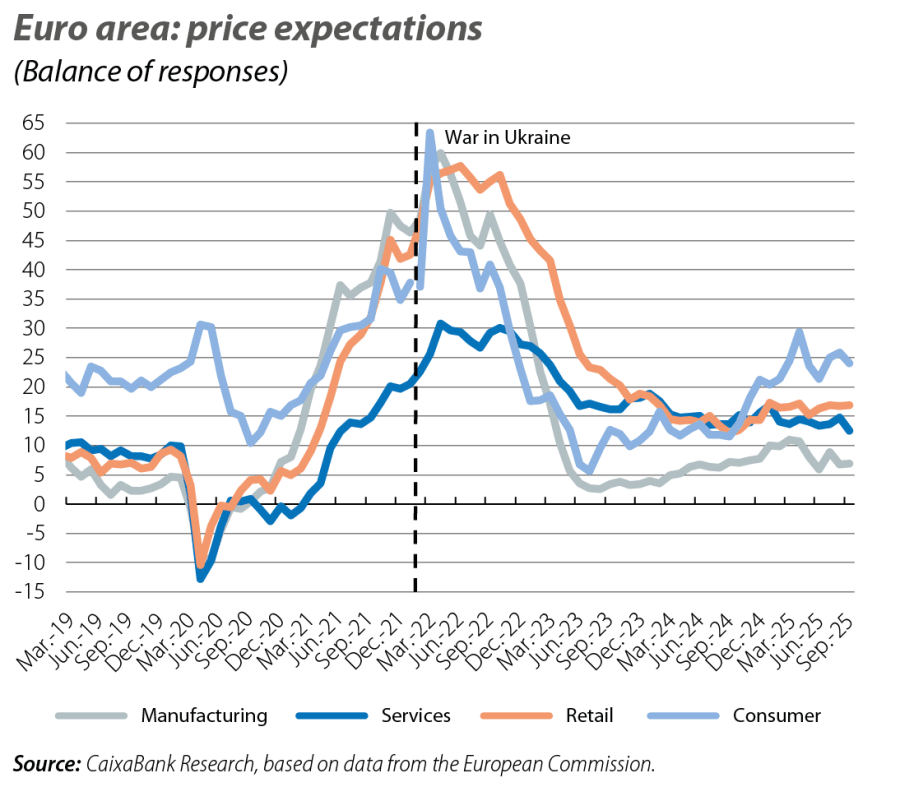

In this context, inflation has remained stable around the ECB’s target: in September, the headline inflation rate was at 2.2%, while the core index remained at 2.3% for the fifth consecutive month. In addition, the inflation expectations of economic actors remain quite subdued: despite higher tariffs, business leaders in the manufacturing, retail and service sectors in September still did not show any intention to raise selling prices significantly, and consumers were also confident that prices would remain relatively stable.

America continues to surprise with its dynamism, despite the weakening labor market

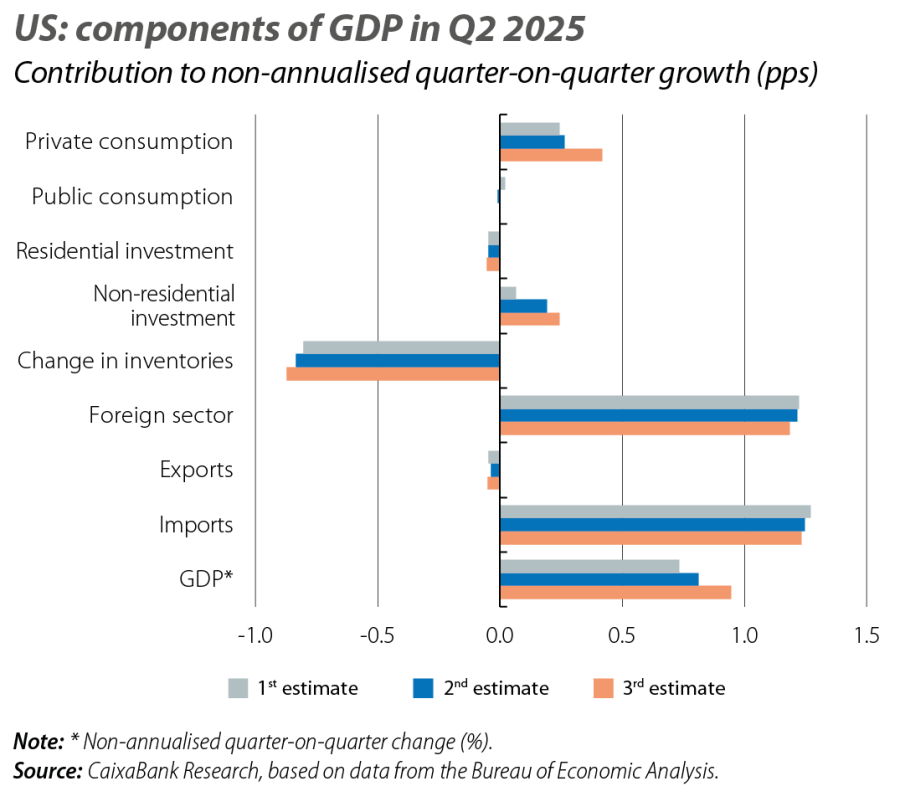

The US economy continues to show little evidence of the impact of rising tariffs. For starters, the final GDP revision showed growth of 0.95% quarter-on-quarter in Q2, compared to 0.8% initially published. This increase was driven by private consumption remaining strong (+0.6%), supported by highly dynamic fixed capital investment (1.1%) amid a greater investment drive in new technologies and AI (computer equipment +2.8% and software +6.1%). Additionally, the latest data also points to a strong third quarter. In fact, in August, private consumption continued to grow (retail sales rose again by 0.6% month-on-month) and industrial production remained high. With all this, the Fed’s GDP tracker in New York and Atlanta shows that GDP has increased by 0.6%-0.9% quarter-on-quarter in Q3.

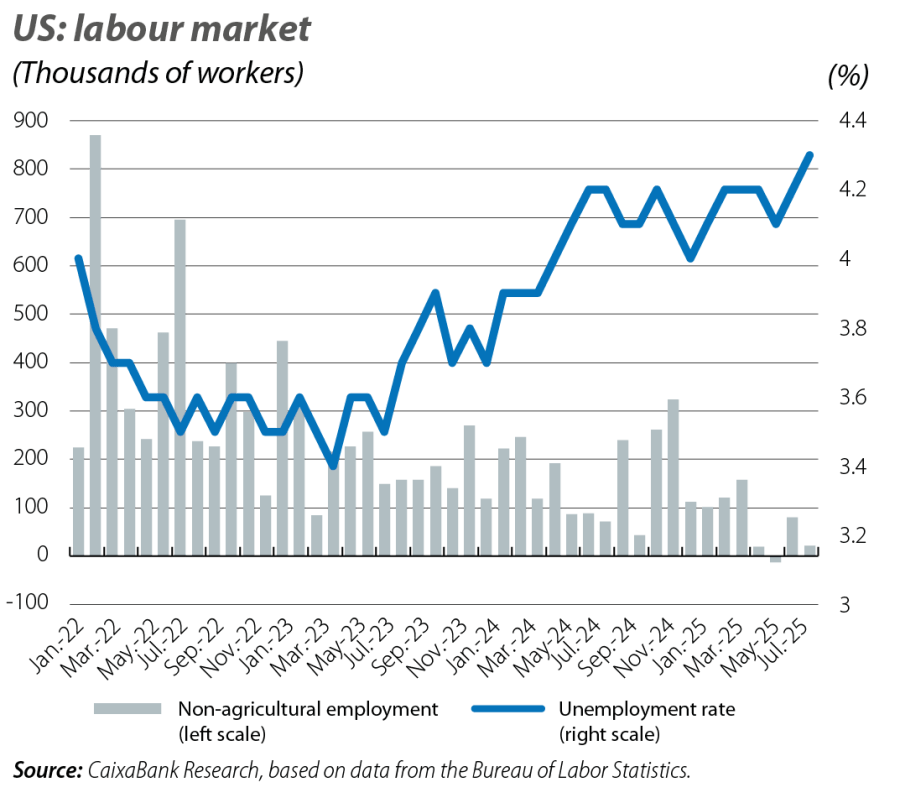

In this context of economic dynamism, inflation continues to show resistance to decline: in August, the headline rate rose by 0.2 pps to 2.9%, while the core index rose only 0.1 pps to 3.1%. While these figures are still above the reference level of 2%, the data shows that tariffs have had little impact so far, perhaps because companies are absorbing most of the cost increases they incur. However, the latest labor market data is starting to show signs of fatigue. Revised annual statistics show nearly 911,000 fewer jobs in the April 2024-March 2025 period compared to initial estimates and in August only 22,000 jobs were created, compared with an average of more than 100,000 jobs in the first four months of the year. Meanwhile, the unemployment rate has risen to 4.3%, compared with 3.5% at the start of the year.

The US federal government is facing a shutdown

The US federal government was facing a government shutdown, at the time this report closed, due to the lack of agreement between Republicans and Democrats to approve the budget (the main point of contention was health spending cuts). The first government shutdown in seven years means that all non-essential services are suspended until a new budget is approved. The impact on growth will depend on how long it lasts, but historical evidence suggests that the impact is usually limited, especially as most of the losses caused by government shutdowns are recovered once governments reopen. In fact, the five-week partial government shutdown between 2018 and 2019, the longest in US history, cost an estimated $11 billion (just 0.05% of GDP) according to the Budget Office, and nearly 75% of those losses could be recovered once the government resumed normal operations.

China’s domestic demand remains weak

Retail sales grew by 3.4% year-on-year, compared to an average of 5.4% in Q2. This loss of momentum will continue in the coming months: household spending will be weighed down by the exhaustion of the effect of tax incentives, which had encouraged purchases of durable goods at the start of the year. Meanwhile, industrial production maintained a strong growth rate of 5.2% year-on-year, although 1 pp lower than the second quarter average, and going forward the company will face more demanding external environmental challenges. In fact, in August, China’s exports grew by 4.8% year-on-year (compared to a 7.4% year-on-year increase in Q2), weighed down by a nearly 33% year-on-year decline in exports to the US.

Source: CaixaBank Research