What is the recession, and does it return?

With the high inflation and the slowdown of employment, a frightening word returned in the conversation: “stagnation”.

It is widely seen as a nightmare economic scenario, it is a rare double blow to high prices and weak growth, and consumer pressure in the exit line and in the labor market.

“The whiff of the recession is increasing,” wrote a professor of economics at Harvard University Jason Foreman on the social media platform X on Thursday. “There are no good options for studying the Federal Reserve given the set of conditions we face.”

Foreman’s warning followed new data for the Ministry of Labor, which shows that consumer prices have increased by 2.9 percent in August of the previous year, which is the fastest annual pace since January. Meanwhile, employment slowed sharply, unemployment rate – now 4.3 percent – at its highest level in four years.

These conditions have put FED policy makers in a difficult place: reduce interest rates to support the labor market or keep them higher for a longer period to reduce inflation to the target of 2 percent.

It is a copy of the same dilemma that was inhabited by cash officials in the 1970s and early 1980s, when the recession appeared, in the end it leads inflation and unemployment to double numbers.

Today’s image is not harsh, and spread – if he returns – can look different. Here is what to know.

What is the “stagnation”?

“The recession”, a mixture of “recession” and “inflation”, describes the extraordinary situation where the economy stops while the cost of living continues.

It is uncommon because it challenges the traditional economic logic: the slow -demand economy usually cools, which helps to maintain prices under examination. The recession turned this scenario – high costs even with upset growth.

The same term was formulated in 1965 by British politician Ian McCloid, who described it as “the worst world.”

Almost a decade later, the Americans became aware of the concept when inflation exceeded 9 percent, and unemployment meat was near this level in 1975. It has pushed several factors to rise, but a series of shocks of oil prices and loose monetary policy were major engines, and the problem remained for years.

Inflation appears to be 2.9 percent and 4.3 percent of unemployment, compared to comparison, but both are currently heading to the wrong path, and linking the hands of the Federal Reserve.

There is no clear line when the recession begins, and the United States can see a more moderate version that does not reach the utmost seventies and early eighties.

Why subscription attention?

The recession hurts consumers through stress portfolios when the times are already difficult, and it is a headache for the federal reserve because it is very difficult to fight.

Politics makers have two main goals: the maximum employment and stable prices, but the recession motivates them against each other.

The Federal Reserve usually raises interest rates to tame inflation and cut them to fight job losses, but when both problems are tightened at one time, there is no simple playing book.

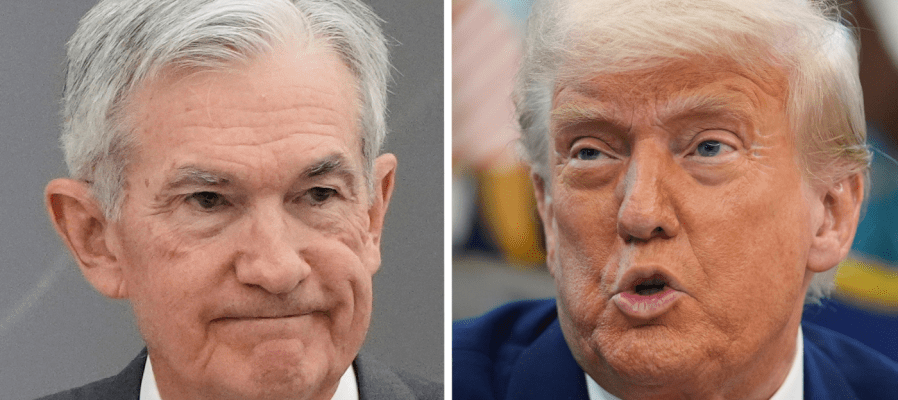

In April, Federal Reserve Chairman Jerome Powell warned that President Trump’s new tariff was “much greater than expected” with the possible effects that included “higher inflation and slower growth” – a recipe for inflation.

Since then, inflation has risen, and the labor market has been reduced, with the economy decreased in June for the first time in 4.5 years. Separate data released this week showed that the labor market was weaker than he had previously thought for some time, even before Trump took office.

The Federal Reserve is expected to reduce prices at its meeting next week, which is a transfer to support jobs, although inflation still exceeds its goal of 2 %.

“The difficult question that will start in the discussion: How much is the condemnation they must continue to cut, as the rushes are sacrificing away from the goal?” Sarah Foster, a bankrate analyst, wrote in a note on Thursday, a warning of the risk of inflation.

Why the recession might seem different this time

The recession can return, but this does not mean that it will be severe – or it lasts for a long time – as happened decades ago.

A piece has argued from the point of view of modern sincerity, “stagnation: not the seventies”, that many forces behind the previous crisis, such as the shocks of oil supplies and union -based wages, are not in play today.

“We believe that although things are not perfect, they are barely bad, and the economy is still expanding,” said Bradford Al -Aneath of the Felletis Capital Group of the Capital.

Inflation has risen since Trump’s ads in April, but so far not with the high rise in many economists. In August, Powell suggested that the effect of definitions on inflation could be relatively short, a view he called “a reasonable essential issue”.

Unemployment infiltrated 4.3 percent, and outside health care, job seekers face a difficult time. But 10 percent levels of the early 1980s are still far.

The end result can be a kind of “Rose-Light”, as inflation continues to be over the goal of the Federal Reserve of 2 percent without stretching, while the growth loses momentum. This is barely good news, but it is better than the worst scenario.

“The full recession is rare and it is likely to remain in this way,” wrote Chenggon Chris Woo, Vice President and Director of the Fedaged Hermes.